20+ paycheck calculator south dakota

Use ADPs South Dakota Paycheck Calculator to estimate net or take home pay for either hourly or salaried employees. As an employer in South Dakota you are responsible for paying unemployment insurance to the state.

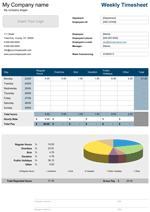

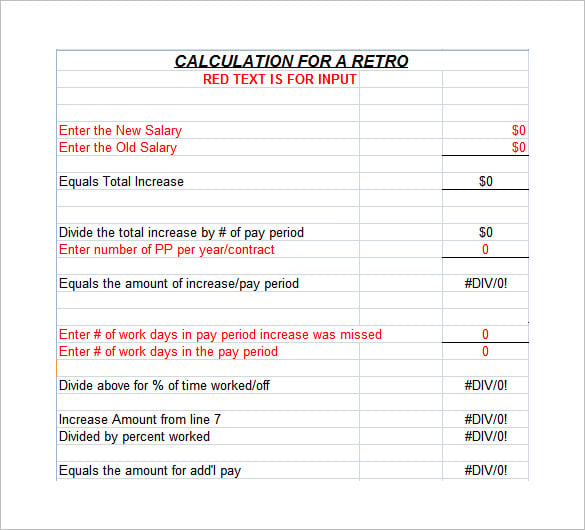

Free 6 Sample Net Pay Calculator Templates In Pdf Excel

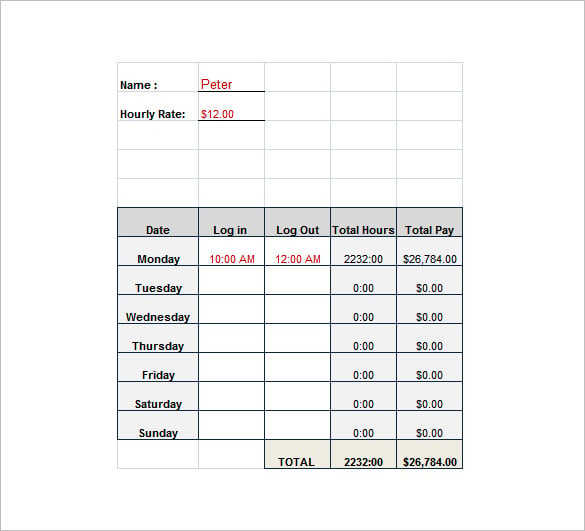

This South Dakota hourly paycheck.

. South Dakota Alcohol Tax. Just enter the wages tax withholdings and other information required. This free easy to use payroll calculator will calculate your take home pay.

South Dakota Paycheck Calculator. South Dakota Hourly Paycheck and Payroll Calculator. South Dakota Cigarette Tax.

Simply enter their federal and state W-4. Supports hourly salary income and multiple pay. From 170050 to 215950.

Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W4 information. South Dakota state income tax. The South Dakota Salary Calculator is a good calculator for calculating your total salary deductions each year this includes Federal Income Tax Rates and Thresholds in 2022 and.

SOUTH DAKOTA REAL WAGE CALCULATOR. From 215950 to 539900. Need help calculating paychecks.

Real Wage Calculator see how your job options stack up by comparing salaries in up to three different locations. After taxes how much of your. South Dakota South Dakota Hourly Paycheck Calculator Results Below are your South Dakota salary paycheck results.

The rate ranges from 0 all the way up to 93 on the first 15000 in. Make Your Payroll Effortless and Focus on What really Matters. Calculate your South Dakota net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free South.

Calculating paychecks and need some help. Ad Compare Prices Find the Best Rates for Payroll Services. Calculating your North Dakota state income tax is similar to the steps we listed on our Federal paycheck.

Use Gustos hourly paycheck calculator to determine withholdings and calculate take-home pay for. So the tax year 2022 will start from July 01 2021 to June 30 2022. South Dakota has a population of under 1 million 2019 and is home to Mount Rushmore and the Badland.

Besides the federal progressive tax bracket system there also exists the alternative minimum. Cigarettes in South Dakota are taxed at a rate of 153 per pack of 20 slightly lower than the national mark. Use Gustos salary paycheck calculator to determine withholdings and calculate take-home pay for your salaried employees in South Dakota.

The median household income is. Along with the sales tax.

Take Home Paycheck Calculator Hourly Salary After Taxes

Free Paycheck Calculator Hourly Salary Usa Dremployee

Kings Kourt Apartments 2500 S Dakota Ave Sioux Falls Sd Rentcafe

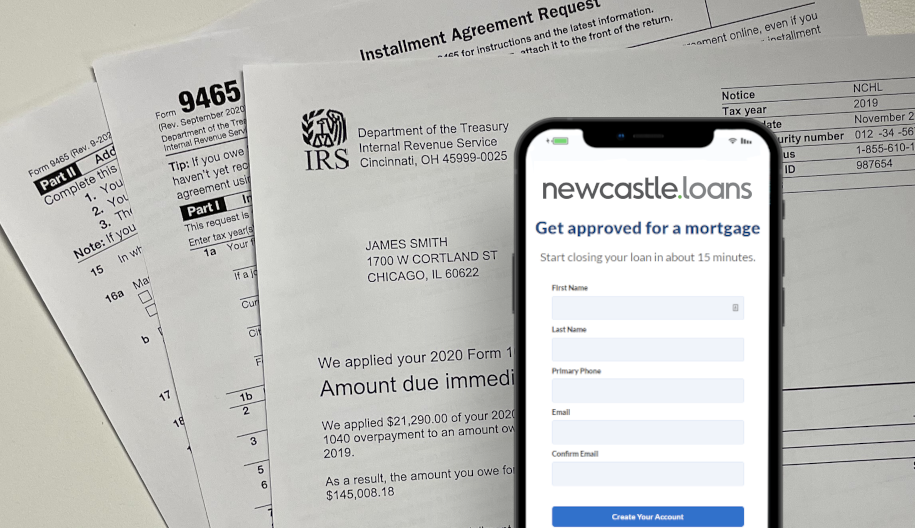

Cash Out Refinance Find My Way Home

Army Pre Retirement Briefing Hq Army Retirement Services Dape Rso 200 Stovall St Alexandria Va March Ppt Download

Characteristics Of Minimum Wage Workers 2020 Bls Reports U S Bureau Of Labor Statistics

Round Robin Betting What Is A Round Robin Bet

Paycheck Calculator Template Download Printable Pdf Templateroller

Gas Furnace Vs Heat Pump Cost Calculator Running Cost Savings Comparison Pickhvac

Can I Get A Mortgage If I Owe Federal Tax Debt To The Irs

South Dakota Hourly Paycheck Calculator Gusto

How Are Payroll Taxes Calculated State Income Taxes Workest

Is Instructional Design The Right Career Experiencing Elearning

South Dakota Paycheck Calculator Smartasset

8 Salary Paycheck Calculator Doc Excel Pdf Free Premium Templates

:max_bytes(150000):strip_icc()/female-small-business-owner-making-a-financial-report-of-her-company-from-a-pie-chart-on-his-laptop-while-sitting-in-an-exclusive-restaurant-1171102644-4da3c27c958c49c09ee9486e59c0e2a8.jpg)

Taxes On Wages And Salary Income

8 Salary Paycheck Calculator Doc Excel Pdf Free Premium Templates